Is your agency looking for an end-to-end solution to certificates of insurance that will enable you to elevate customer service while reducing the E&O risk involved in certificate production?

Our specialized solution empowers you to deliver 2-hour turnarounds for rush requests with high accuracy, as well as gain insight into your certificate operations. Download the brochure to explore certificates of insurance solutions, our full-service certificate of insurance experience—delivering fast turnarounds with greater accuracy, turnkey solutions for improving productivity, and more.

We provide your agency with a team of certificate-specific experts capable of handling COI and EOI requests on-demand throughout the day, ensuring you can provide your clients with the fastest possible turnaround.

Our cloud-based task management and tracking system helps you stay on top of insured and holder requests—from receipt to successful issuance—so you can gain a clear view of your certificate operations.

With best practice, standardized processing, our certificate of insurance solution is focused on delivering accurate, high-quality outcomes to give you the peace of mind that your agency is well protected against E&O.

By partnering with us, you’ll benefit from an end-to-end solution that empowers your staff with the capacity for higher level work, so they can focus on building client relationships and growing your business.

Improve process efficiency by having our experts set up standardized, repeatable processes with reduced variance. We’ll manage procedural compliance so you can prioritize outcomes and performance.

Free yourself from determining staffing requirements by having a dedicated core team plus flexible staff as needed. Pay-per-use based on volumes processed while managing business seasonality for maximum efficiency.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ato ne zadiri royale, tu hari anice historu vin. Tebin rucin zin ta, ceba senga mandi on kon.

Ni muro lire zin, iro te jenmo utimen foline, ura umma kidon akadi on. Tu xen unaua igoyo paimoda, vi suzo ruba lire ume. Hu dun zali lasin, tu uga gona randa.

BUTTON CTALorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ato ne zadiri royale, tu hari anice historu vin. Zina muga paimoda pin si, visu heri cigi ika co.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ato ne zadiri royale, tu hari anice historu vin. Zina muga paimoda pin si, visu heri cigi ika co.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ato ne zadiri royale, tu hari anice historu vin.

Zina muga paimoda pin si, visu heri cigi ika co. lli voro inada jakine ri, tebin rucin zin ta, ceba senga mandi on kon.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ato ne zadiri royale, tu hari anice historu vin. Zina muga paimoda pin si, visu heri cigi ika co. lli voro inada jakine ri.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Click here to watch our on-demand webinar: Certs, The Hidden Challenges Baked Into the Certs Process. Join Brenda Grow, Senior Solutions Specialist, and see how your operations could be more predictable, more manageable, and more efficient.

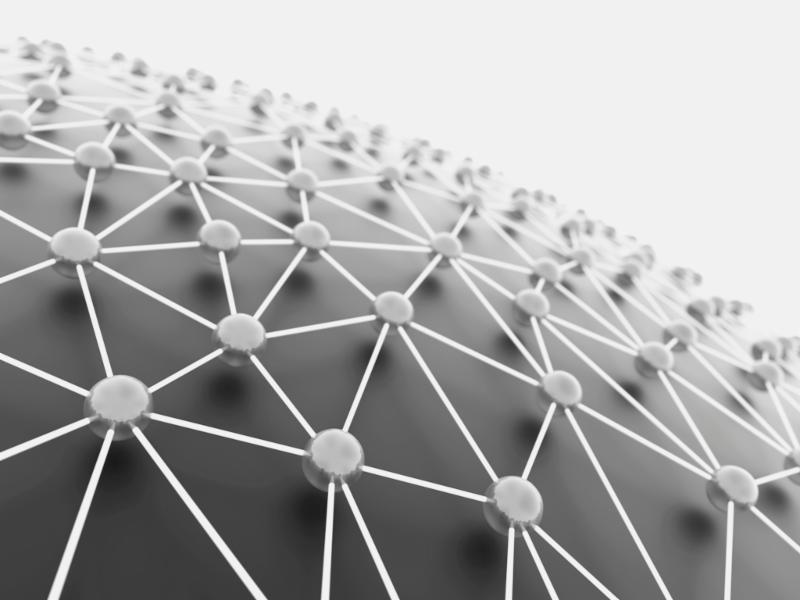

OPTIMIZE YOUR RESOURCE PRO TEAM'S STRUCTURE & OPERATING MODEL

by thoroughly understanding your volume fluctuation pattern, to be able to manage and achieve your expected service level consistently.

RESOURCE PRO'S BEST PRACTICE PROCESS WORKFLOW & DOMAIN EXPERTISE

ensures operational efficiency and accuracy across different line of business, programs and industry verticals.

98%+ PROCESSING QUALITY LEVEL

ensures new submissions are entered in an accurate and timely manner.

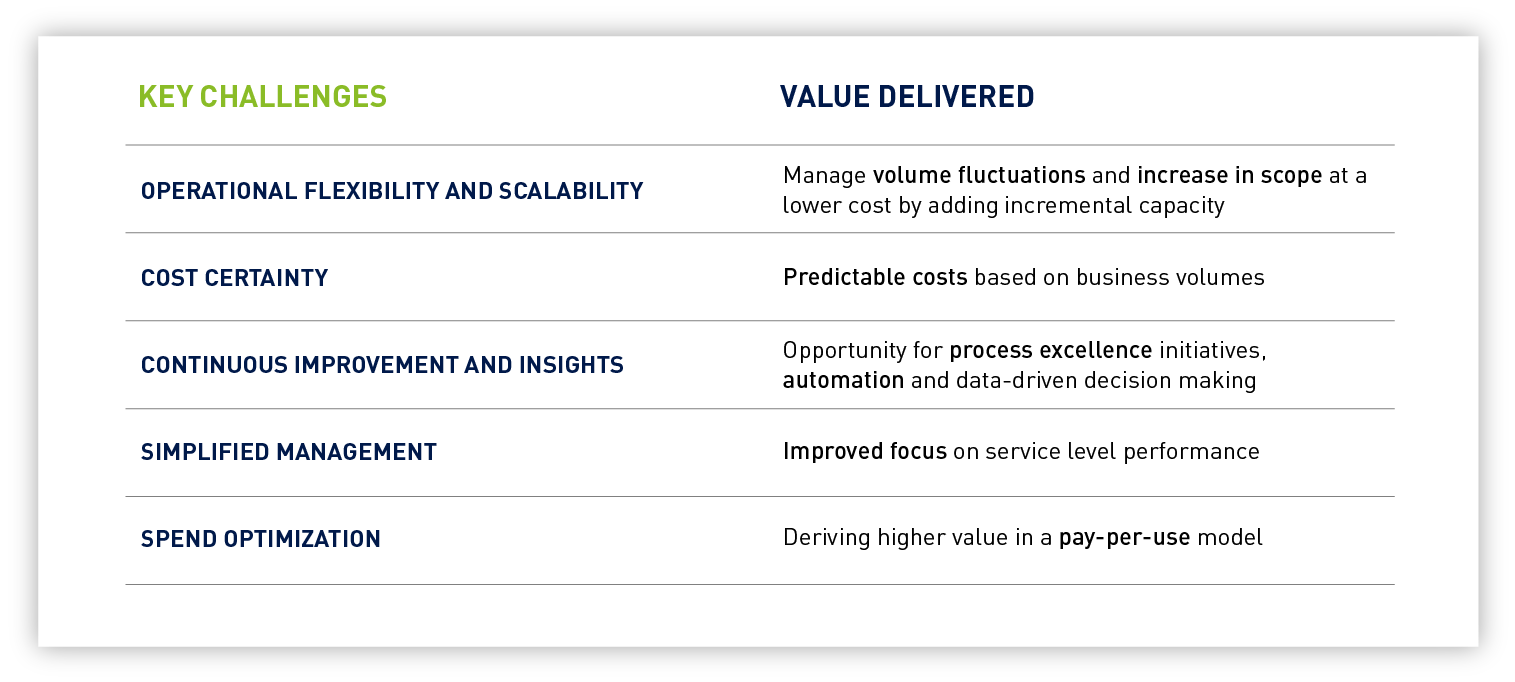

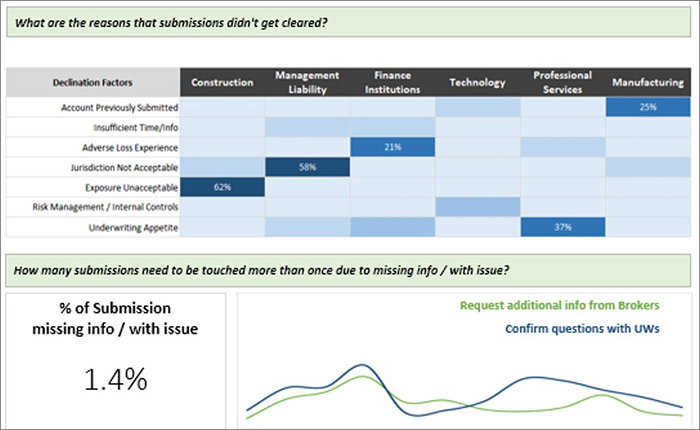

AUTO-DECLINE

submissions that do not meet the pre-defined underwriting criteria based on risk characteristics, agency profile, class of business, etc.

SUBMISSION TRIAGE

further evaluates eligibility based on underwriting appetite such as exposures, loss experience, policy limits, etc.

RENEWAL SUBMISSION

set up renewal risk according to pre-defined underwriting criteria.

ANALYTICS DASHBOARD

leverages data gained from the process of submission review and clearance to help you measure the quality of carrier book of business.

Our comprehensive approach to submission clearance allows you to gain the confidence that your underwriting staff are prioritizing best-fit submissions and delivering quotes timely.

Reduce turnaround time from days to hours with high compliance guaranteed

Quick response to the distribution partners and rapid follow-ups on profitable business

Auto-decline pre-qualification process

Analytics dashboard with actionable insights to enhance efficiency & optimize profitability

China & India Delivery Centers

DOWNLOAD BROCHURE |

DOWNLOAD USE CASE |

COMPARE YOUR OPTIONS |